25 July 2022

Anybody working in technology will be acutely aware of the rising cost of employment. This pressure is balanced against uncertainty in the economy and headlines in 2022 of significant layoffs across the industry. Despite the challenges of the pandemic, the Technology sector continued to grow in 2021. RSM’s recent Real Economy – Supply Chain topical survey found that that almost a quarter of businesses that saw an increase in consumer demand noted a negative impact on their business culture. For many Tech companies, these impacts can be crucial, as the most crucial component of their supply chain is their workforce.

Our review of the FTSE 350

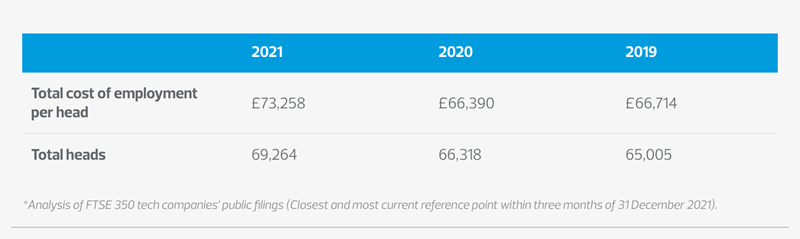

Prompted by the increasing narrative in this area from our clients we reviewed the disclosed employment information in the annual results of Tech companies in the FTSE 350. In selecting our sample, we used the sixteen companies in the FTSE 350 tech index. We have taken the most recent set of accounts within a six-month window around the 31 December 2021.

Our findings

The total cost of employment per head rose by 10.3 per cent to over £73,000 per year in 2021. Total number of people rose by 4 per cent. This is a stark increase from 2020, when the total number of people rose by 2 per cent and total cost of employment decreased by 0.5 per cent compared to 2019.

What’s driving this

The first key factor at play is a labour shortage across all roles in Tech. Demand for employees in technical roles, such as software engineering, is high. A search on LinkedIn for open roles including the word ‘Tech’ recorded almost 44,000 open roles in the United Kingdom alone across the Ecosystem.

Another key driver in 2021 was unprecedented levels of flexibility being offered. This trend has continued, of the 44,000 open roles at the point of publishing this article almost 8,000 are listed as hybrid and almost 5,000 fully remote. Recruitment without location bias in theory allows a better candidate to be recruited into the business but the pay scales can become a global battlefield. As a consequence of the pandemic BigTech have announced unprecedented flexibility in their employment terms, with some offering the option to work across a multiple number of countries. The packages offered by BigTech are some of the most lucrative – and their ever-increasing reach drives costs up for everybody.

As a recession looks more likely, strategic investments in the workforce are needed to ensure businesses remain competitive. Long-term investors are now asking boards for evidence of progress and return on investment in the near-term. Of the 44,000 open roles on LinkedIn almost 23,000 relate to engineering and information and technology. Almost 11,000 are in the sales, marketing and business development functions needed to drive the success of the business. This war for talent is across all departments in the organisation.

A final factor that cannot be ignored is the impact on inflation on the cost of living. Employees are looking to their business to look after them as part of their pay review. For the board, instability in the team can cause delays that are not welcome news to demanding investors. For many organisations a reluctance to address the cost-of-living crisis can be seen by the workforce as a betrayal of their broader culture to keep teams engaged and happy.

Layoffs

A mitigating factor in 2022 may be the unwelcome news of downsizing in Tech. Crunchbase reported that over 30,000 employees of US Tech companies had been laid off by July in 2022. Over 50 per cent of layoffs were late-stage post Series-C Tech, with FinTech in particular being hard hit. This release of skilled labour into the market may have an impact of increasing competition for roles and an easing to businesses of employment cost.

Boards may be making these decisions out of prudence, as businesses sail into uncertain headwinds. As noted above, pressure from investors to deliver results and returns means that costs that can be made in discretionary spending (including employees) are making changes.

Another factor is the ‘post-pandemic slump’. Platform-based businesses saw unprecedented success during the digital business environment during the pandemic. In July ‘HopIn’ – an online events platform – announced a 29 per cent layoff of workforce, following earlier reductions in February. HopIn are far from the only business that achieved enormous valuations for investment during the pandemic only to be impacted as the world changes again.

The impact in 2022

It looks likely that cost of tech employment has continued to increase in 2022 – and likely accelerated in the first six months of this year.

These rising costs are difficult for management to benchmark across all functions including engineering, sales, marketing and administration. But management teams are working hard to ensure packages are as competitive as possible, and communication across the organisation about these efforts can be key.

Further layoffs seem likely, if not inevitable. Unfortunately for many, boards will already be considering scenario analysis for their own organisation. Those who are looking to recruit may benefit from a competitor’s decision to restructure or take their foot off the recruitment pedal.

Boards may want to consider adaptations that have no cash cost, such as greater adoption of hybrid working. Some many want to mimic the global schemes offered by BigTech – but these global schemes can come with expensive compliance costs for the individual and corporate. Greater hybrid working can allow pay-rises to be mitigated by reduction in premises space – but this can also have a negative impact on culture and productivity, depending on roles and teams. There is no perfect answer.

Share incentive schemes

The use of share incentive schemes is widely adopted across Technology. Ultimately, in an environment when heads can be turned by the offer of a lucrative move, many may choose to remain in a business if the potential rewards of the option scheme over time feel viable.

Approximately 4 per cent of total employment cost can be attributed to share options expenses – a rise from 2 per cent in the 2020 period. The amounts recorded in accounts amount to an estimate of value implicit in the options awarded, which is a highly complicated and judgemental area of accountancy.

However, the use of option schemes can be a crucial lever for boards to tie workforces to the long-term success of the business. There is a cost to the business in the form of surrendered equity – but this cost may be outweighed by the benefit of a team that are engaged in the shared success of the company over the long term.