11 June 2024

The UK’s economic outlook looks its brightest since the start of the pandemic. But the recovery is still fragile and should be treated with caution.

Inflation should continue to slow over the next few quarters and is likely to remain close to the Bank of England’s (BoE) 2% target for the foreseeable future, allowing for interest rate cuts from late summer.

Rising household incomes and improving consumer confidence will set the stage for a recovery in consumer spending in the second half of this year. We doubt that the election will derail that story, whoever wins.

The UK’s economic outlook post-recession is cautiously optimistic for the upcoming year and next. Households and businesses may not yet be feeling the benefits of this improvement, but with lower inflation, strong wage growth and potentially falling interest rates from August, consumer spending and business investment will eventually feel a boost.

The UK General Election on 4 July is not anticipated to disrupt this recovery, as both major parties share similar economic policies. Tight fiscal constraints will mean that the new government will be limited in their ability to stimulate the economy.

However, the economy’s growth is still hindered by the employment rate sitting below pre-pandemic levels and stagnant productivity. Addressing these issues, particularly workforce participation and productivity, is crucial for sustainable economic growth and should be a priority for any new government.

- UK inflation

- UK labour markets

- UK interest rates

- UK consumer power

UK inflation

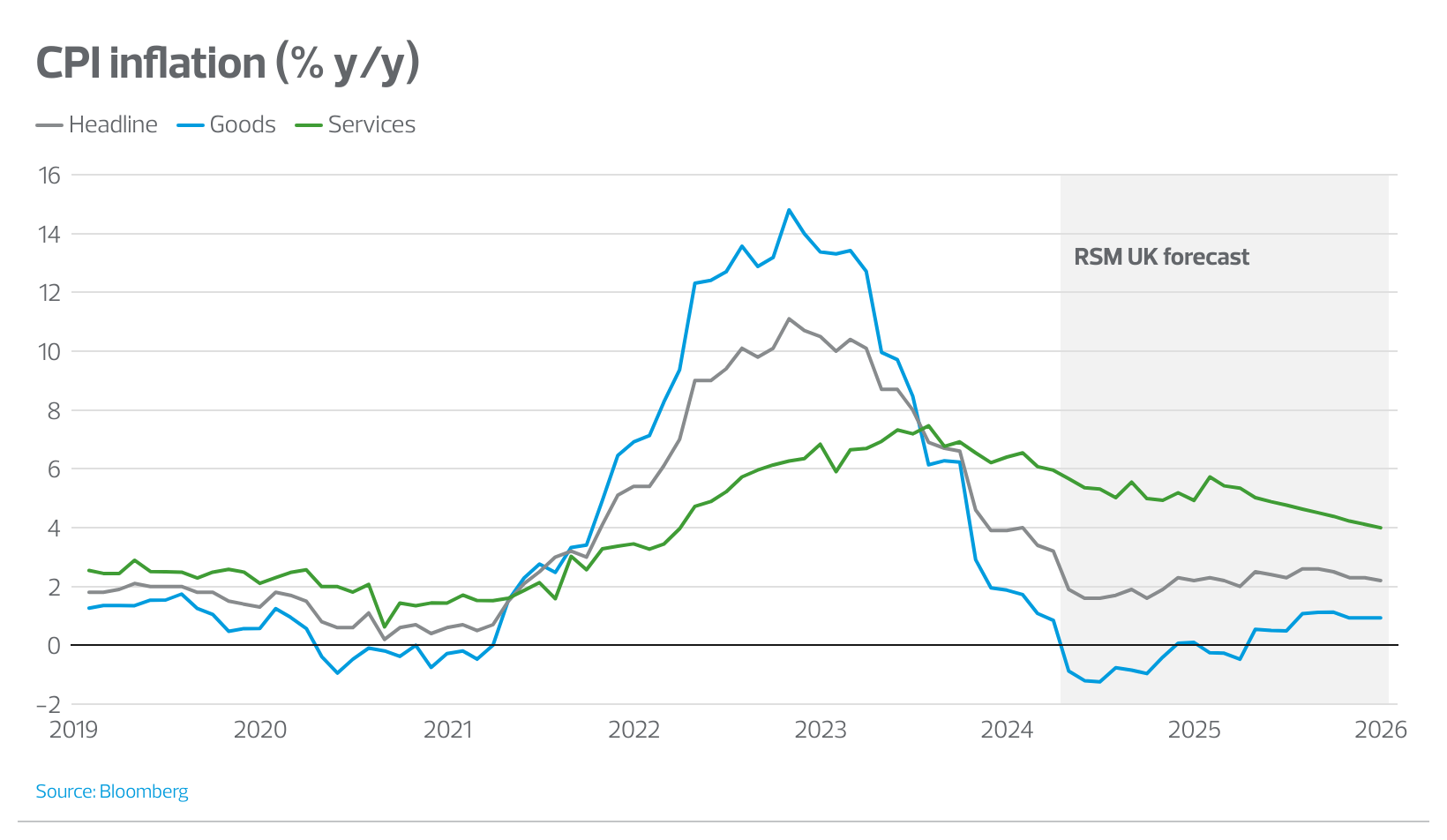

Headline UK inflation is expected to remain between 2% and 2.5% for the rest of this year and into the next. But the headline rate masks disparities between goods and services prices. Goods inflation has turned negative, with a –0.8% rate in April, and is likely to continue dragging down the headline rate for the next year. In contrast, services inflation, although down to 5.9% in April, will stay above 5% until next year due to lagging input price changes and rising labour costs. Wage growth is expected to decrease, which may ease services inflation, but dealing with elevated wages in a high interest rate and low inflation environment will be a new challenge for the services sector.

UK labour markets

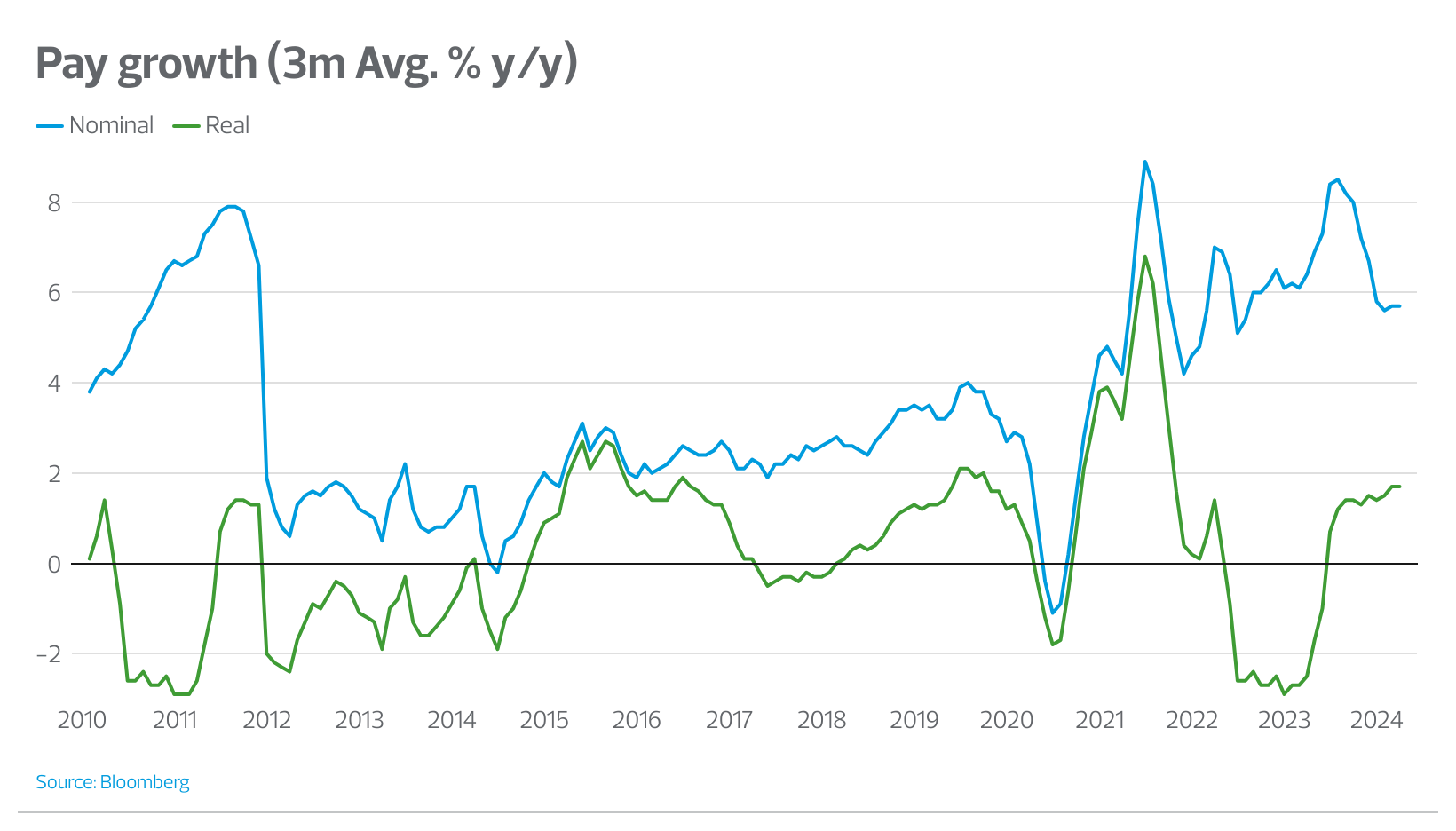

The UK labour market is showing signs of easing, with the unemployment rate expected to rise to 5% by the end of 2024, leading to slower wage growth. Despite concerns about the accuracy of labour market data, trends indicate a softening market, with a decrease in hiring and vacancies. Economic growth should stabilise hiring, but an increase in labour supply is expected, which will likely slow wage growth further. By the end of 2024, unemployment is projected to sit at 4.5%, and wage growth is expected to decelerate to 4.5% by the end of this year and then to 3% by the end of 2025.

UK interest rates

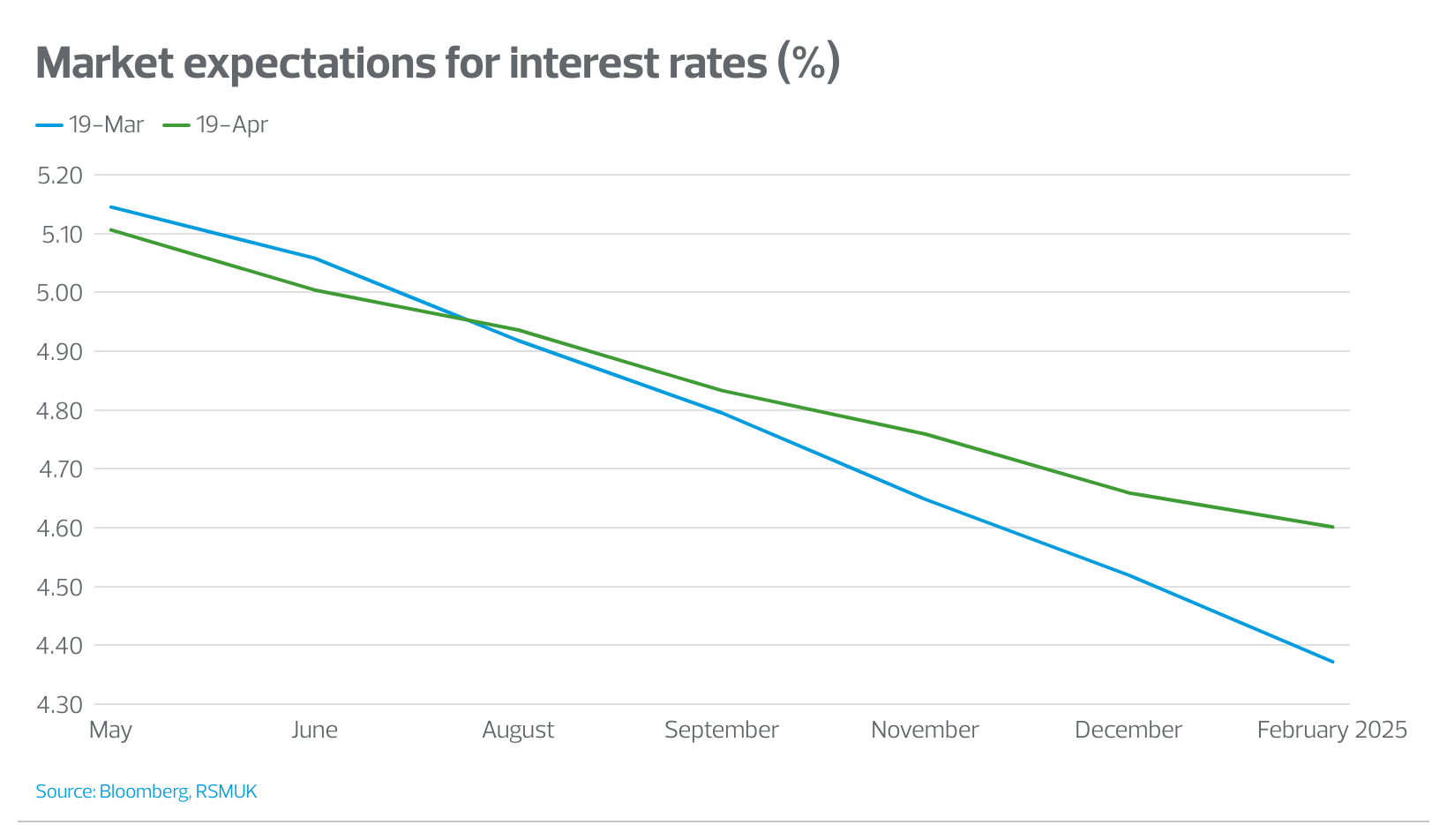

The significant decrease in UK inflation has prompted the BoE to consider reducing interest rates starting this summer, with three rate cuts expected in 2024, bringing rates down to 4.5% by the end of the year. The Monetary Policy Committee (MPC) has recognised that the current rate of 5.25% is now restrictive and is open to rate reductions without fuelling inflation. The pace of rate cuts will be gradual, influenced by economic data and fiscal policies of the new government. Tax policy changes could allow for more rate cuts, potentially reducing rates to 3.5% in 2025, with a long-term expectation of rates settling around 3%.

UK consumer power

By the second half of 2024, households should start to benefit from increased real incomes, tax cuts and falling interest rates, which will boost disposable incomes and consumer spending. Despite a lingering impact from the cost-of-living crisis, real incomes have been rising and are set to grow faster than consumer prices. Interest rate reductions and tax cuts will further enhance disposable incomes. Consumer confidence is recovering, and savings have been replenished, leading to an anticipated rise in consumer spending by 0.8% this year and 1.3% in 2025. This spending increase is projected to drive economic growth, with GDP growth averaging around 0.3% quarter-on-quarter for the next two years, marking a significant improvement from the last four years.

Download the full report

UK quarterly economic outlook report

The Real Economy

Moody's White Paper