13 May 2022

The start of 2022 has been a rollercoaster for global streaming companies. They have had to contend with more competition than ever before, against a backdrop of the rapidly increasing cost of living. Arguably it is Disney+ that is in the strongest position, with Netflix subscribers widely anticipated to top out and decline in the next quarter. How these streaming companies perform will have a direct impact on the UK’s world-leading TV and movie production industry. Streaming also has its part to play in UK cinema’s recovery.

So, what’s happened?

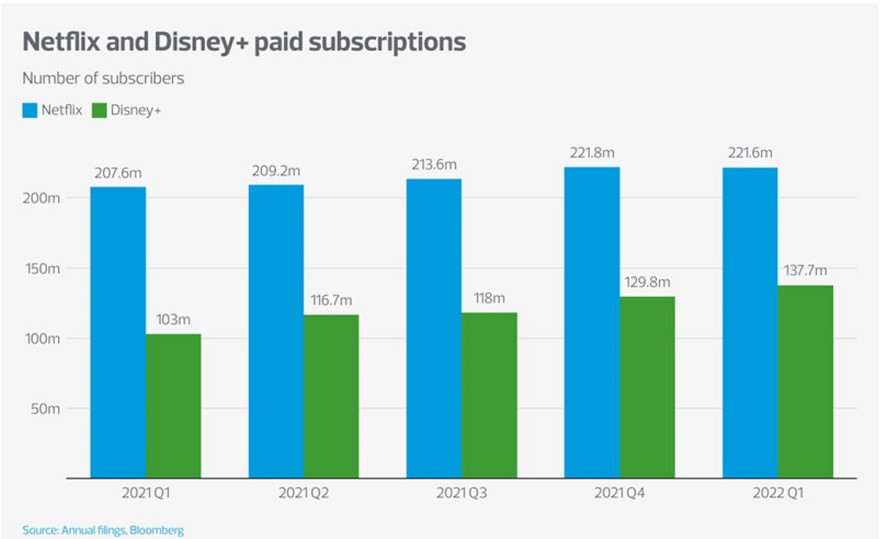

In the first quarter of 2022 Netflix reported a net loss of 200,000 subscribers and projected an additional 2 million subscriber exodus in Q2. Netflix ended Q1 with 221.64 million paid subscriptions, a decline from the 221.84 million it had at the end of 2021. This announcement caused its stock price to crash by roughly 25 per cent, closing under $350 per share. In response, Netflix has issued plans for a lower-tier of subscription that will include advertising and that it plans to crack-down on password sharing. Netflix also announced a scaling back of future content spend.

Netflix’s results and proposed plans have proved unpopular with both investors and customers. In May this year a group of shareholders launched a class-action lawsuit against Netflix alleging inadequate disclosures were made around the business’s operations and prospects.

In contrast, Disney reported a 6.1 per cent rise in streaming subscription numbers in quarterly results to March 2022. Average monthly revenue per paid subscriber in the US for Disney+ rose from $6.01 is $6.31. International subscribers saw a steeper rise from $5.15 to $6.35. In the earnings call on 11 May 2022, Bob Chapek, Disney CEO, also suggested that a ‘Disney+ ad tier’ would allow them to hit a broader market and continue to scale. Chapek did make the point Disney+ launched with ‘an extremely attractive opening price point’ and indicated this would be monitored carefully in future.Of course, Disney offers more than just streaming – it is a movie studio, theme park operator and TV broadcaster, amongst many other things. Of all things, intellectual property and content are at the core of what Disney do across all divisions. Chapek commented that Disney are ‘carefully watching our content growth’.For both Netflix and Disney, the balance between their competing price points and the content they can stream into our devices is going to be key in the battle for the streaming market.

Pricing is becoming crucial as cost-of-living increases

In the UK, household budgets are tightening. Whilst RSM’s UK economist, Tom Pugh, has predicted the UK will ‘narrowly’ avoid recession - an uncomfortable fact for Netflix and Disney, is that a streaming subscription might now be seen as a household luxury, and therefore at risk to tightening purse strings.

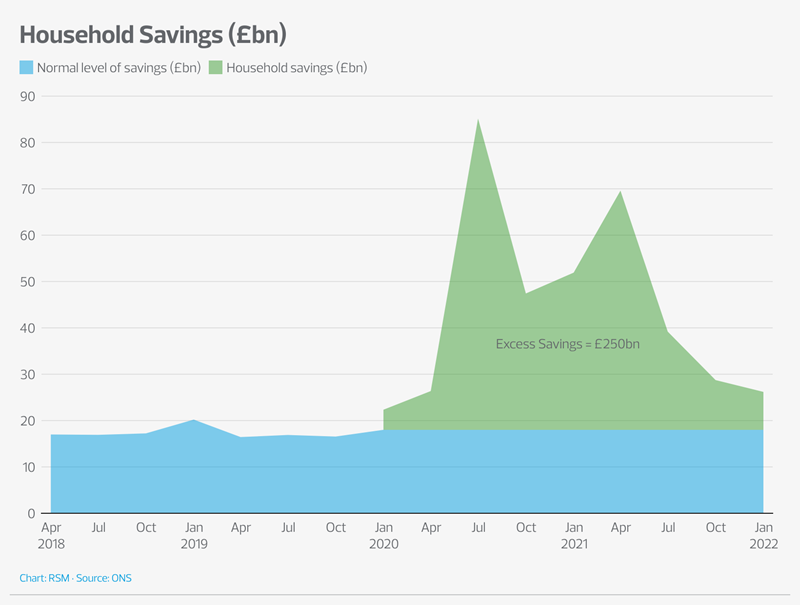

Strong household balance sheets were created during the pandemic, with close to £250bn of excess savings being held in the UK. However, this pile of savings is not evenly distributed. The bottom 40 per cent of households have fewer savings now than they did before the pandemic. Now that households are seeing a staggering rise in the direct debit for energy costs, alongside rising interest rates impacting those with mortgages, a streaming subscription may seem like a low monthly cost, but any outgoings now will be being scrutinised.

This brings into focus an inherent challenge with the software as a service (SAAS) based model – it is very easy to switch on and to switch off. The cost to cancel Netflix is effectively nothing, you can plan a month ahead and cancel. If you want to turn it back on, it’s also easy to do so. This makes Netflix – and any other SAAS product – inherently vulnerable in the current circumstances. To further exacerbate the problem, viewer habits have changed to ‘binging’.

Having the best content will be key to attracting and retaining subscribers

You may have seen Disney+ advertising the new Star Wars TV show, Obi-Wan, as a ‘6-part experience’. In the past it would have been called a TV show or a ‘box-set’. But viewer habits have changed.

A ‘boxset binge’ is the consumption of an entire season or franchise of movies or a series over an intense period. Traditional television was released on a carefully planned weekly schedule. Whilst Netflix and Disney in some cases try to phase episodes across weekly release slots, fans are comfortable waiting for a complete season to be available or signing up just for the month when a show they enjoy is being released.

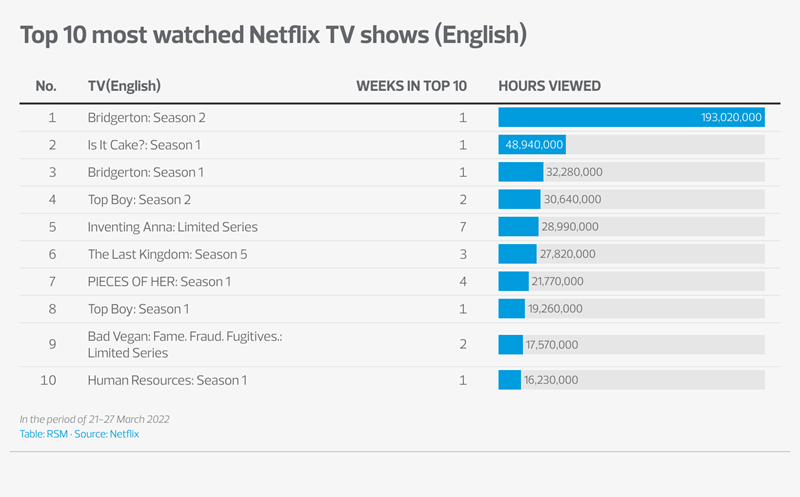

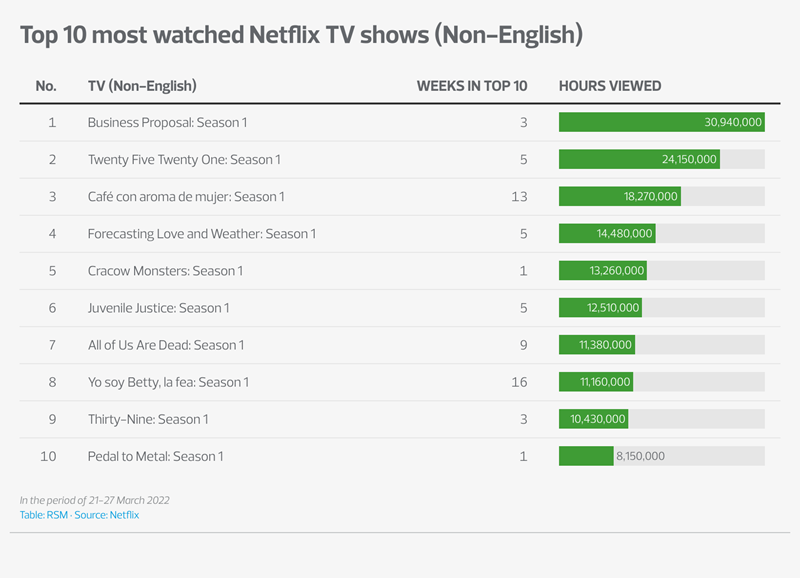

Netflix report the numbers for their weekly most-viewed shows and movies. A review of the final week of Q1 demonstrates a recurring theme – viewer interest is short lived. Of the English-speaking shows, half of the top-10 have only existed in the top-10 for just one week. The pattern is comparable, although not quite as stark in non-English speaking shows. Streaming viewers commonly buy access for a month and binge a whole season of the latest show. Then they may choose to flip between providers to meet this viewing habit, increasing the importance of fresh content to draw viewers back.

Slowdown in streaming commissions may be harmful to UK TV production

With both Netflix and Disney communicating a more cautious approach to content spent – they will be looking for maximum quality in what they do commissions. Netflix is, and will continue to be, a vast commissioner of fresh content on a global scale. Netflix recorded cash outflows of $3.6bn in first quarter of 2022 for content additions. Total cash outflow for 2021 was $17.7bn. Disney also announced they will be ‘careful’ with spend, but they have the benefit of sitting across almost 100 years of history and IP. Disney’s global content spend is approximately $30bn.

So, it is highly likely that both Netflix and Disney will be enormous players in entertainment commissioning. However, the news of spending cuts may be a concern to UK production studios, who have been working at record-breaking levels. The good news is that the UK is a world leader in this industry, but it will be crucial to continue to attract overseas investment.

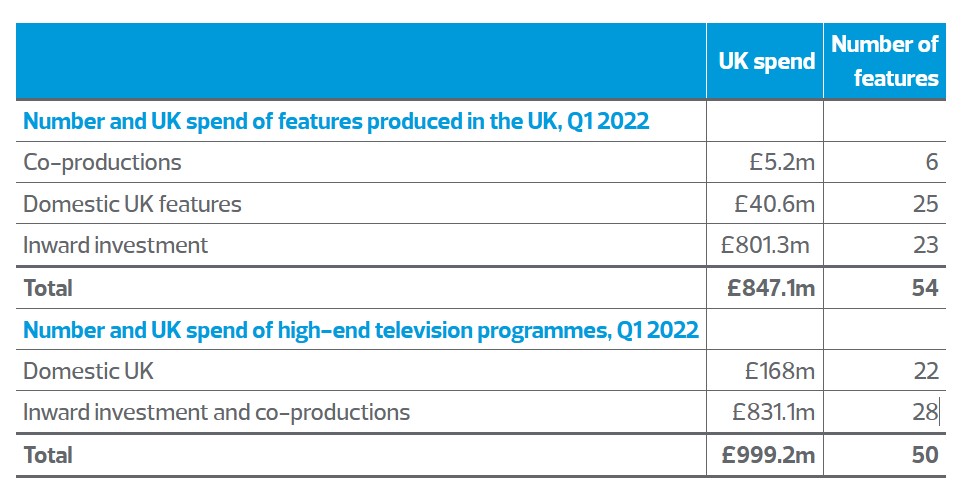

Research from the British Film Institute reports that the combined UK spend on features and high-end TV production for the period April 2021 to March 2022 was £6.6bn. This figure was a 102 per cent increase in the comparative year – which is not surprising, as the pandemic disrupted production globally through 2020. Looking to early 2022, first quarter spend was £1.85bn across 104 productions. It is clear from these numbers that inward investment is vital. Within this total spend - 1.6bn was from overseas.

The industry might look to domestic commissions – but this is not likely to be anywhere as buoyant as overseas income. The BBC has indicated that, whilst they will look to services to achieve cost savings of £1.5bn over the next five years, programming may be impacted. Any shortfall in international commissions is not likely to be covered by an increase in domestic spend.

Table source: BFI Research and Statistics Unit

What about heading to the movies?

In 2021 we asked if 007 would save cinema. The answer is yes, but he had some help from a friendly neighbourhood Spider-Man.

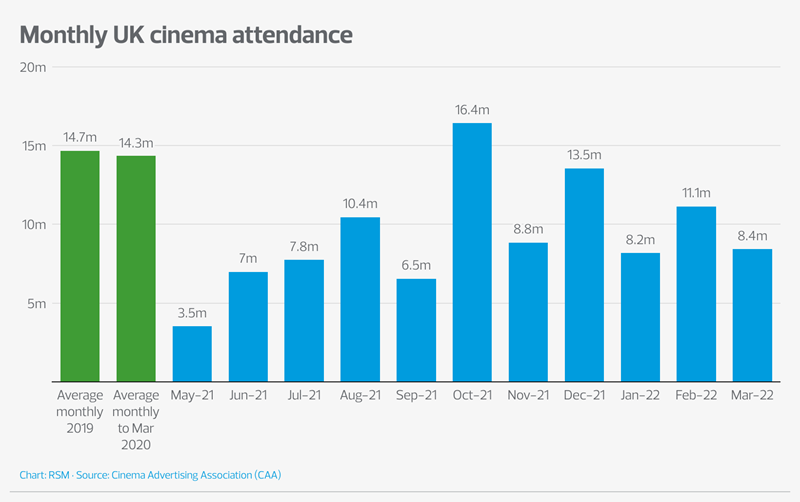

The moviegoer’s return to the theatre has been good news for UK cinema, defined by the return of the Hollywood blockbuster. Enormous numbers for the latest Bond and Spider-Man movies created immediate spikes that approached pre-pandemic levels. The average cinema attendance numbers in the UK is still rising and it will be important for that to continue through the traditional summer blockbuster season. Many movies being released in the summer of 2022 have been delayed by the pandemic, including additions to the Marvel cinematic universe and the long-awaited sequel to 80s cult favourite, Top Gun.

Increasing attendances at cinemas will be welcomed by many other businesses in this sector who suffered through 2020 and 2021. Netflix may be less pleased.

Adding to Netflix’s misery is their direct competitor - Disney’s – dual-wielding position as both production studio and streamer. Disney is less vulnerable to the return of the movie-theatre. They were able to release their acclaimed animated movie Encanto on both streaming and into theatres at the same time. Their position as a business that controls a broad, diverse eco-system is inherently stronger than Netflix. This puts Disney in the driving seat moving forward.

Who wins – Netflix or Disney?

Whilst Netflix popularised streaming, Disney have wielded it to create a whole new revenue arm within a broader, diverse business. They are masters of creating and then monetising their IP through a vast and diverse range of complementary divisions, products and experiences.

Furthermore, in the last 12 months we have seen Disney begin to subtly entwine the Disney+ experience into the ‘Disney bubble’. An easily missed but important announcement from Disney was that their subscribers can currently access discounts at Walt Disney World resort hotels – creating a linkage between the theme park resorts and streaming divisions.

Their theme park experience is increasing mobile device enabled engagement, with guests being able to navigate and plan their days on their mobile devices, and even enjoy unique augmented reality experiences across attractions. The ‘Galaxies Edge’ additions to the theme park are connected to the newer Star Wars movies and Disney+ shows, with only a passing nod to the original trilogy from the 70s/80s.

In early 2022, Disney announced that you can now purchase Disney furniture with subtle design cues relating to the resorts and company. At what point will we be able to order furniture, merchandise or a hotel stay through the Disney+ platform during a show? It is likely that this is the plan and a gateway step towards a broader metaverse model.

Netflix have begun to diversify their business model by expanding into gaming – a gamified version of Exploding Kitten lands later in the year. With over 200m subscribers Netflix could change this industry by opening new markets. Furthermore, if Netflix becomes the replacement for the family board game, the monthly fee may transition from household luxury to necessity.

To conclude…

Streaming numbers are likely to begin to top-out. Some analysts have assessed the global market at 400m households. There is increasing competition from other BigTech companies including Amazon Prime, which we have not considered here. As household budgets become tighter the value received for monthly service will be under increasing scrutiny.

Disney appear to be in a strong position, having integrated Disney+ into the broader portfolio of Disney offerings. Whilst Netflix are the largest streamer, they are a relative newcomer but their expansion into gaming is certainly an area to watch.

All streamers will need to balance cost of service against quality of content. Whilst content spend is being scaled back, it will still be an area of enormous global spend. The UK’s TV and movie production industry will be looking to attract as much of this spend as possible.

And finally, after a very difficult pandemic, we are beginning to see UK cinema goers return. Disney’s ‘Dr Strange in the Multiverse of Madness’ opened with £19.5m in the UK - the first of many Hollywood blockbusters expected in 2022. The credits have not yet rolled on film fans attending the movies.